As any savvy business owner knows, managing your company's financial health is a bit like walking a tightrope. You need to carefully balance bringing in enough income to cover your costs and generate a profit, while also ensuring you don't overextend yourself too quickly. It's a delicate balancing act, but with some strategic planning, it can absolutely be done!

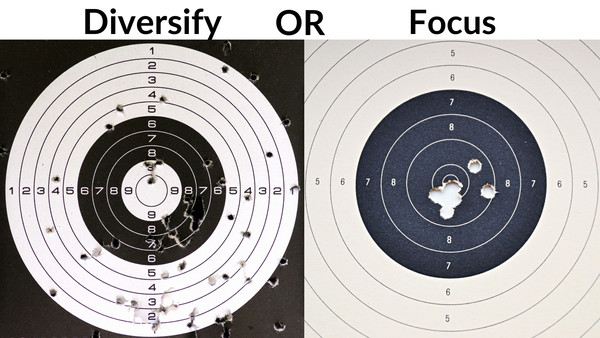

On one hand, you want your business to grow at a pace you can manage financially. Expanding too rapidly when cash flow is tight can spell disaster down the road. You want controlled, sustainable growth that keeps up with, but doesn't drastically outpace, your revenue. No one wants to soar high only to come crashing down!

On the other hand, you can't be so conservative with your spending that you stunt your growth potential. Making smart investments, whether it’s in equipment, technology, marketing, or talent, is often essential for moving your company forward. You have to spend money to make money, as the saying goes! The key is finding that sweet spot where you're minimizing unnecessary expenses but still investing adequately in growth.

Additionally, ensuring you have proper cash flow and a healthy profit margin is critical. You want to bring in enough monthly to not just cover fixed costs, but also have some left over to pad your bottom line. There will always be unexpected costs popping up, so having extra cushion is crucial. An unforeseen expense can’t sink your ship if you’ve got spare life rafts!

While you want your business to be financially sound month-to-month, it's also critical to think long term. Consider where you want your company to be in 5 years, 10 years or beyond. Set long-range goals for growth and profitability, and ensure your shorter term spending aligns with the big picture vision. This includes slowly building up emergency savings funds, retirement savings, and money reserved for future investments.

Finding the right balance may take some adjusting at first, but staying financially fit and nimble is well worth the effort. Just take it slowly, watch your budget diligently, and make careful, calculated moves towards growth. Before you know it, you’ll be balanced and ready to take your business to the next level!

For a free financial fitness review, send a request to book a call with Helene Sewell Business Navigator at helene@the-business-navigator.com

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

As a business owner, you likely keep a close eye on your cash balance and maybe less so on your profitability. Both metrics offer critical insights into the financial health and sustainability of your company. However, it's important to understand that cash in the bank and profit do not always go hand-in-hand.

Reasons You Can Be Profitable But Cash Poor

There are a few key reasons why a business may be making a profit without having the cash to show for it:

Clients paying later - If you offer credit terms to customers, you may have to wait 30, 60 or even 90 days to collect payments after making a sale. You made the sale but you won't have the cash in hand until later.

Inventory/Stocks or Supplier Bills - Selling products means you have money tied up in inventory. You may have to pay for this stock before you get the chance to sell it and collect the cash for it.

When providing services, you pay your staff at the end of the month they have worked, yet you may not charge the client until the following month and get the cash in another 30 days later.

Investing in Growth - When aggressively spending on new equipment, R&D, hiring, facilities and other investments for future expansion, short-term cash flow takes a hit even if profits rise over time.

The danger of this disconnect is that you may not have the working capital needed to keep funding operations, make payroll, and pay near-term obligations.

Reasons You Can Have Cash But Be Losing Money

On the other side, it's also possible for a company to have strong cash reserves or cash flow but still be losing money when profits are calculated:

You may how money to the tax man for VAT. This money is in your bank and strictly speaking is not yours and it is not profit you have made.

Customers may be paying you deposits for goods and services you have not delivered yet. This money has not been earned yet, and you may have to make some refunds.

In these cases, you could be tempted to spend money that is not yours and find yourself short when that debt is called in. Monitoring both metrics is vital.

The key in any business is finding the right balance between profitability and cash flow over both the short-term and long run. Understanding when and why these two critical measures may not fully align is the first step toward maintaining this balance and financial health.

If you have concerns over your profitability or cashflow and need clarity on your position and how to improve it, send me a DM and I will be happy to have a free insight call with you.

#businessaccounting #profileoptimization #profit #cashflowmanagement #fridayinspiration

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

This blog post discusses the different types of budgets commonly used by businesses and challenges the traditional view of budgets as a financial target. The author highlights four main types of budgets - incremental, activity-based, zero-based, and value proposition - and critiques their limitations. The post suggests that budgets should be viewed as a validation tool for the strategic planning process and as a navigation tool for achieving desired results. By integrating budgets into business planning and management reporting, they can contribute to great leadership and commercial success.

In a recent blog post, the author challenges the conventional wisdom that budgets are crucial for business success. After 25 years of experience, they have never encountered a business owner who credits their achievements to a budget. The author explains the four main types of budgets - incremental, activity-based, zero-based, and value proposition - and points out their limitations. They argue that budgets should be seen as a validation tool for strategic planning and a navigation tool to guide decision-making. By integrating budgets into the business planning process and considering both financial and non-financial targets, businesses can enhance their leadership and commercial success.

Read more...