Considering the statistics that suggest businesses are 88% more productive with the support of a mentor, it begs the question why not every business works with one.

The psychology around hiring a mentor is complex.

Common characteristics amongst entrepreneurs are, independence, single mindedness, problem solvers and self belief. All of which go against the willingness to ask for help.

But then 50% of businesses fail in the first 5 years and only 40% of business put up for sell, will find a buyer, the rest are dissolved. This seems such a waste of time, creativity and money.

So when should an entrepreneur hire a mentor?

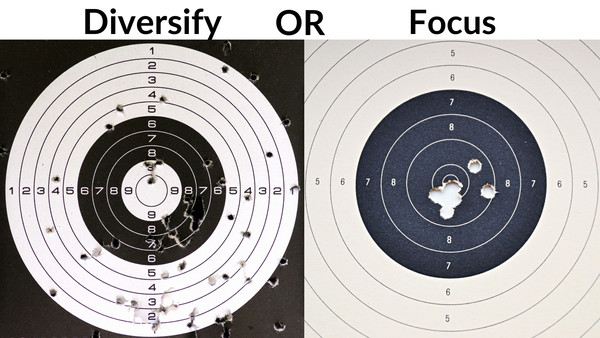

The decision process on whether/when to get help consists of answering 2 simple questions.

How successful do you want to be?

What are the consequences if you fail?

Let's take some examples.

Would you hire someone to show you how to dance?

Assuming the occasion is your wedding day, here are likely answers to each question:

Q1 Answer: I don’t really care how well I dance

Q2 Answer: If I fail, it could make for a funny wedding video.

So the answer is no.

Now different assumption: you want to impress someone you are attracted to.

Q1: Yes it would be good but I could impress that person other ways

Q2: Failing is not really a big deal, if the person has a sense of humor

One last assumption

Now let's say you want to go skydiving

Q1: it's just for fun , you are not planning to be a professional.

Q2: if you get it wrong, it is fairly fatal….

Not

So ask yourself the 2 questions and make the right decision for yourself.

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

Let's be real - having ADHD while running a business is like riding a rollercoaster blindfolded. The ups, the downs, the sudden twists...it's one wild ride. As mentor and business coach for neurodivergent entrepreneurs, I've got a front-row seat to the challenges and perks.

Let's start by acknowledging three major drawback of the ADHD brain:

- Time Blindness when the concept of time is more abstract art than physics. Does it exist? How does it work? What even is a second? For ADHDers, schedules and deadlines are lowercase suggestions rather than rules set in stone. This makes sticking to routines, meeting time-sensitive goals, and hitting investor deadlines...um, let's just say "difficult."

- Shiny Object Syndrome. They are the easily distracted mavens of -- oh look, a squirrel! Between impulse decisions, newfound obsessions, and constant boredom, shiny object syndrome is real. It's hard to sustain focus on one big goal when every passing intrigue pulls their attention like oooh, let's disrupt the frisbee industry or import rubber duck moustaches from Finland! But fear not, I'm focused again no-- wait, one sec...

- Financial Forgetfulness Those with ADHD have a propensity for constantly losing things like keys, willpower, and their trail of thought, making keeping finances and operations organized an uphill battle. Important invoices get missed and parking tickets accrue at an alarming rate because their filing "system" is really just a blackhole. If you loan someone with ADHD $20, you might just want to get it in writing. Or be prepared to renounce all belongings to the ADHD Tax.

But lest you think it's all chaos and downsidess, check out three awesome superpowers ADHD entrepreneurs bring to the table:

- Perpetual Idea Machine Their mind is like a volcano, constantly erupting with lava-hot ideas, unique perspectives, and random creative bursts. While most have to attend brain-boosting workshops to "think outside the box," those with ADHD just...live there. They see problems from a totally different angle, making those eureka moments practically second nature.

- Lords of Hyperfocus Mention something they're genuinely intrigued by and it's like injecting them with ultra-concentrated motivational serum. Their ability to hyperfocus on topics that captivate them isn't just a party trick - it's a legitimate superpower. They've coded for 12 hours straight, surviving only on caffeine and blind fixation, emerging with crazily innovative solutions.

- Unshakeable Courage What's riskier - investing your life savings in a revolutionary crypto startup or simply trying to withdraw cash while having ADHD? The way they see it, nothing is too scary to attempt when you've already mustered the guts to step out into the world as a distractible, impulsive adult. They don't get hung up on potential failure - they'd rather chase their craziest ambitions than be paralyzed by fear.

At the end of the day, being an entrepreneur with ADHD is a wild, chaotic, magnificent, and maddening experience. They have the ambition, grit, and creative brainwaves to take on the world...if they can only figure out where they left their strategic plan, wallet, and pants. But that's just how they roll - an unpredictable, eccentric evolution of genius and dazed looks. Controlled disaster, patent pending.

If you identify with those traits and want to leverage the superpowers while getting the drawbacks under better control, just send me a one word message HELP and I will be there to help. I won’t give up on you if you don’t.

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

As any savvy business owner knows, managing your company's financial health is a bit like walking a tightrope. You need to carefully balance bringing in enough income to cover your costs and generate a profit, while also ensuring you don't overextend yourself too quickly. It's a delicate balancing act, but with some strategic planning, it can absolutely be done!

On one hand, you want your business to grow at a pace you can manage financially. Expanding too rapidly when cash flow is tight can spell disaster down the road. You want controlled, sustainable growth that keeps up with, but doesn't drastically outpace, your revenue. No one wants to soar high only to come crashing down!

On the other hand, you can't be so conservative with your spending that you stunt your growth potential. Making smart investments, whether it’s in equipment, technology, marketing, or talent, is often essential for moving your company forward. You have to spend money to make money, as the saying goes! The key is finding that sweet spot where you're minimizing unnecessary expenses but still investing adequately in growth.

Additionally, ensuring you have proper cash flow and a healthy profit margin is critical. You want to bring in enough monthly to not just cover fixed costs, but also have some left over to pad your bottom line. There will always be unexpected costs popping up, so having extra cushion is crucial. An unforeseen expense can’t sink your ship if you’ve got spare life rafts!

While you want your business to be financially sound month-to-month, it's also critical to think long term. Consider where you want your company to be in 5 years, 10 years or beyond. Set long-range goals for growth and profitability, and ensure your shorter term spending aligns with the big picture vision. This includes slowly building up emergency savings funds, retirement savings, and money reserved for future investments.

Finding the right balance may take some adjusting at first, but staying financially fit and nimble is well worth the effort. Just take it slowly, watch your budget diligently, and make careful, calculated moves towards growth. Before you know it, you’ll be balanced and ready to take your business to the next level!

For a free financial fitness review, send a request to book a call with Helene Sewell Business Navigator at helene@the-business-navigator.com

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

Success. It's a seemingly simple word that carries a world of connotations, dreams, and—let’s admit it—incessant Google searches for the answer to life's most elusive questions: “How can I be successful?” The query has variously delivered everything from meditative enlightenment to the geeky delights of a new time-management app. But what if there’s more to success than just a list of morning affirmations or a tidy desk?

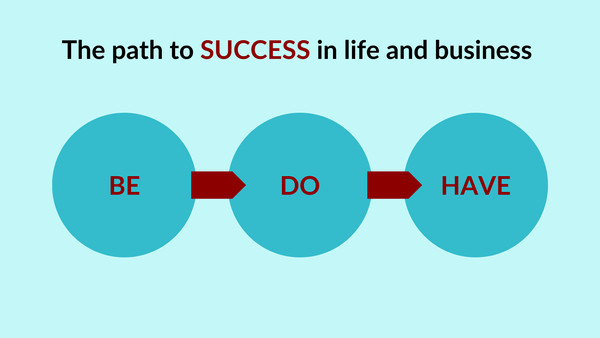

Let's embark on an odyssey through an unconventional dimension of success—one that involves three small words with the potential to re-engineer your life's course: Be Do Have. It’s not a trendy hashtag or a whimsical philosophy. It's a robust, tested methodology that can help you architect both personal triumphs and corporate victories.

The Beginnings of Be Do Have

The Be Do Have principle is not new. It's been whispered at leadership seminars, scribbled in self-help book margins, and emblazoned on motivational posters. But seldom has it been dissected and presented in a manner that makes it a practical, everyday mantra. At its core, Be Do Have is about a fundamental shift in mindset and action—one that doesn’t obsess over the possession of success but promises to build it from your core.

A Framework of Self-Realization

The concept is inherently simple: you must first become the type of person who is capable of achieving what you want (Be), then you must act in a way that’s consistent with the identity you seek (Do), and only thereafter can you expect to receive what such a successful being with successful habits would have (Have).

Embracing the Be Do Have Mindset in Business

Be Do Have isn't confined to personal milestones; it's a framework for professional development. It fosters a culture wherein employees are encouraged to embody desired traits and skills to achieve their professional aspirations and drive company success.

Cultivating Excellence in the Workplace

Businesses that implement Be Do Have principles reap the rewards of a more driven, proactive workforce. Employees who ‘are’ ambitious, innovative, and collaborative, and who ‘do’ work in sync with these attributes, lead to companies that ‘have’ increased profitability and a heightened competitive edge.

The Path to Innovation

Innovation, the lifeblood of many modern businesses, is deeply rooted in the Be Do Have cycle. By encouraging a culture of experimentation and continual learning, organisations help employees ‘be’ innovative thinkers. Channeling this mindset into new projects and strategies ensures that the company ‘does’ produce groundbreaking work, leading to the enviable position of ‘having’ a reputation for innovation.

Be Do Have: A Blueprint for Personal Leadership

Personal development strategies are often fleeting, like the winds of New Year's resolutions. But what if you could anchor yourself to a system that doesn't just guide change but ensures it resonates with your being?

Leading by Example

Self-imposed leadership is the most influential kind. By focusing on the qualities of a great leader, an individual ‘becomes’ a person others willingly follow. This self-actualised leader then ‘does’ what such a leader would, naturally guiding and inspiring others. The outcome is a community or team that ‘has’ the structures and support to excel.

Life as a Continuous Experiment

Living the Be Do Have way is embracing a life that’s not simply reactive, but actively shaped. It’s an ongoing series of experiments, where you embody new roles, take on different attitudes, and see what you can manifest.

Future-Proofing Through Personal Transformation

The world is in a state of perpetual transformation. Markets fluctuate, technologies evolve, and careers shift like the sands of time. In the face of such fluidity, the Be Do Have cycle offers an anchor to personal growth and resilience.

Professional Adaptability

Consider the professional skills you need to ‘be’ in 10 years. Start acquiring them now. Adapt your work habits and learning methods to what you ‘do’ when the skills are fully integrated. Finally, picture the professional ‘having’ that comes with mastering those future skills.

Navigating Life Transitions

As we navigate through life’s inevitable transitions, from career changes to personal milestones, the Be Do Have principle remains a compass. By aligning our actions with our evolving sense of self, we ensure that the fruits of success are harvested from within.

Conclusion: Your Be Do Have Journey

Success is not some remote, admirable figure to be beheld from afar. It’s not an exotic destination to be reached on a whim. It’s a state of being that blossoms from within, shaped by the daily toils and trials of ‘doing’ the necessary work.

Your journey with Be Do Have will likely have its share of questions, uncertainties, and even periods of doubt. But remember, the journey of a thousand miles begins with a single step, and with each step, you define the person you are, the actions you take, and the outcomes you deserve.

As you travel this path, reflect on the mantras of Be Do Have. Carry them with you through your entrepreneurial ventures, your career aspirations, and even your quiet moments of personal growth. Waves of success will come, certainly, but the lasting ripples of your being, doing, and having will navigate the shores of your success with an inimitable purpose.

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!

As a business owner, you likely keep a close eye on your cash balance and maybe less so on your profitability. Both metrics offer critical insights into the financial health and sustainability of your company. However, it's important to understand that cash in the bank and profit do not always go hand-in-hand.

Reasons You Can Be Profitable But Cash Poor

There are a few key reasons why a business may be making a profit without having the cash to show for it:

Clients paying later - If you offer credit terms to customers, you may have to wait 30, 60 or even 90 days to collect payments after making a sale. You made the sale but you won't have the cash in hand until later.

Inventory/Stocks or Supplier Bills - Selling products means you have money tied up in inventory. You may have to pay for this stock before you get the chance to sell it and collect the cash for it.

When providing services, you pay your staff at the end of the month they have worked, yet you may not charge the client until the following month and get the cash in another 30 days later.

Investing in Growth - When aggressively spending on new equipment, R&D, hiring, facilities and other investments for future expansion, short-term cash flow takes a hit even if profits rise over time.

The danger of this disconnect is that you may not have the working capital needed to keep funding operations, make payroll, and pay near-term obligations.

Reasons You Can Have Cash But Be Losing Money

On the other side, it's also possible for a company to have strong cash reserves or cash flow but still be losing money when profits are calculated:

You may how money to the tax man for VAT. This money is in your bank and strictly speaking is not yours and it is not profit you have made.

Customers may be paying you deposits for goods and services you have not delivered yet. This money has not been earned yet, and you may have to make some refunds.

In these cases, you could be tempted to spend money that is not yours and find yourself short when that debt is called in. Monitoring both metrics is vital.

The key in any business is finding the right balance between profitability and cash flow over both the short-term and long run. Understanding when and why these two critical measures may not fully align is the first step toward maintaining this balance and financial health.

If you have concerns over your profitability or cashflow and need clarity on your position and how to improve it, send me a DM and I will be happy to have a free insight call with you.

#businessaccounting #profileoptimization #profit #cashflowmanagement #fridayinspiration

Did this blog help you? If it did, please share it with your business connections.

If you have any questions contact Helene HERE

Are you tired of putting off important tasks and feeling overwhelmed by procrastination?

You're not alone!

But fear not! We have the ultimate solution for you.

Introducing "3 Easy Steps to Banish Procrastination" - a downloadable guide that will transform your productivity and help you achieve your goals faster than ever before. Say goodbye to endless frustration and hello to a focused and motivated you. Don't wait any longer, click the link below to unlock the secrets to defeating procrastination once and for all!